ENVIRONMENT

DISCLOSURES ALIGNED WITH THE TCFD RECOMMENDATIONS

Governance

In 2022, the KOKUYO Groupendorsed the recommendations of the Task Force on Climate-relatedFinancial Disclosures (TCFD). We regard climate change as a major strategic concern and have established an organizational framework for managing climate-related risks. Under the supervision of the Board of Directors, the Sustainability Committee identifies climate-related risks so that the management can incorporate the information into strategic planning and take the decisions and actions necessary to mitigate the risks. To supervise this process effectively, the Board of Directors hears reports from the committee twice a year and then deliberates on climate-related risks and other sustainability issues. The board also makes decisions on strategically significant risks.

The Sustainability Committee’s membership consists entirely of managing officers and it is chaired by the Managing Officer of the CSV Division. The Committee monitors social and environmental trends to identify strategic concerns related to sustainability. It then formulates action plans and allocates budgetary resources for addressing these concerns. The Environment Subcommittee (a subcommittee of the Sustainability Committee) collaborates with the managers responsible for each business division to identify climate-related risks, incorporate the findings into strategic planning, and spearhead organization-wide efforts to mitigate the risks.

Strategies

We use scenario analysis to identify climate-related risks and opportunities and their financial implications so that the necessary measures can be taken. Since 2030 is the endpoint for our long-term vision, our scenario analysis projects climate-related shifts in society and among stakeholders between now and that endpoint. Through FY2022 we conducted scenario analysis for the following businesses: furniture and business-supply distribution in the workstyle field, and stationery and interior retail in the lifestyle field.

Scenario Analysis

| Scenario | Description | Main reference scenarios |

|---|---|---|

| Within 1.5 ℃ | Sustainable Development / Net-zero Scenarios: Committing to a net-zero transition by 2050, the world acts to keep global warming below 1.5 ℃ relative to preindustrial times. Government regulation is tougher compared to that in the 4 ℃ scenario, and people take a greater interest than they do at present in climate change and other environmental issues. |

|

| 4 ℃ scenario | Stated Policies Scenario: Government regulation is weak compared to the 1.5 ℃ scenario. There are no further measures or further policy intentions beyond what governments have already implemented or stated. GHG emissions may increase for a time, and people’s interest in climate change and the environment remains as it is now. |

|

Risks and Opportunities

< Workstyle Field >

| Scenario | Furniture Businesses |

|---|---|

| Within 1.5℃ | With growing pressure around the world for a net-zero transition, our customers, suppliers, and other social stakeholders will take more action to contribute to the net-zero transition and to reduce waste. The financial/business risks include higher CO2 emissions costs, the need for more capital spending, higher raw material costs, and a decline in sales revenue following changes in customers’ needs. The opportunities include the potential for developing goods and services to cover shifting customer needs and behavior, and the potential to expand business domains by developing low-emissions businesses. Accordingly, we will seize the opportunity to develop new products and services so that we can create value suited to the changes among customers and in society. |

| 4℃ scenario | Timber prices rise amid the global spread in consumer activism coupled with climate impacts. Manufacturing and transportation become increasingly vulnerable to climate-related disaster risks. The financial/business risks include higher raw materials costs and the risk that hiking sales prices to absorb the cost increases may cause a drop in demand for furniture products. Where physical risks materialize, the risks include opportunity losses, business suspension, and the cost of responding to the incident. We will address the risks by increasing our organization’s resilience. We also eye opportunities in the changing market trends, including the rise of disaster management efforts and new workstyles in our customers’ offices. To capture these opportunities, we will develop new solutions that create value. |

| Scenario | Business Supply Distribution |

|---|---|

| Within 1.5℃ | As the net-zero transition progresses, customers, distributors, and other social stakeholders take more action to contribute to the net-zero transition and to reduce waste. The financial/ business risks include the costs of carbon taxes, higher transport costs, and a decline in sales revenue following changes in customers’ needs. The opportunities include the potential to increase sales revenue with a lineup suited to the shifting customer needs. Accordingly, we will seize the opportunity to change our product lineup and expand our digital measures so that we can increase our climate resilience and create value suited to the changes among customers and in society. |

| 4℃ scenario | Raw material prices rise amid the global spread in consumer activism coupled with climate impacts. Physical risks materialize, disrupting transportation and other parts of the supply chain, which may have severe ramifications for the business model. The financial/business risks include higher costs, both for raw materials and for transportation. Where physical risks materialize, the risks include opportunity losses, business suspension, and the cost of responding to the incident. To address the risks, we will strengthen our organization’s resilience by altering our procurement strategy and expanding digital measures. |

< Lifestyle Field >

| Scenario | Stationery Businesses |

|---|---|

| Within 1.5℃ | The global net-zero transition leads to new consumer and market trends, with consumers changing their attitudes toward stationery and other consumables and with new workstyles and learning styles emerging. The financial/business risks include higher CO2 emissions costs, higher raw material costs, the costs of added investment, and the risk that the stationery market shrinks amid digitalization. The financial/business opportunities include the chance to create new value by developing products and services for Japanese and overseas markets that cater to the emerging trends. |

| 4℃ scenario | Cost pressures increase amid the global spread in consumer activism and the physical impacts of climate change become an increasing threat. The financial/business risks include higher costs in raw materials and energy. Where physical risks materialize, the risks include opportunity losses and the cost of responding to the incident. Financial/business opportunities include a growing demand for stationery in overseas markets. The opportunities can be realized by strengthening resilience, globalizing the supply chain, and expanding in overseas markets. |

| Scenario | Interior Retail Businesses |

|---|---|

| Within 1.5℃ | The net-zero transition increases pressure to realize ecological sustainability, including reducing the CO2 emissions generated in the life cycle of furniture (from production to disposal). The financial/business risks include higher CO2 emissions costs, higher raw material costs, and the costs of added investment. They also include the risk that people purchase interior goods less frequently out of concern for the environment and the risk of increased competition from furniture rental and subscription services. Financial/business opportunities can be realized by balancing business interests with environmental friendliness, such as by carbon footprint labeling and developing services that reduce furniture waste (e.g. repair services). |

| 4 ℃ scenario | Prices for timber goods and other products rise amid the global spread in consumer activism coupled with climate impacts. The supply chain and retail activities become increasingly vulnerable to climate-related disaster risk. The financial/business risks include higher raw materials costs and the risk that hiking sales prices to absorb the cost increases may cause a drop in demand for furniture products. Where physical risks materialize, the risks include opportunity losses and the cost of responding to the incident. To manage these risks, we will strengthen resilience and ensure stable deliveries of our products by altering our procurement strategy and developing our e-commerce business. |

Risk Management

Climate-related risks are managed by the Environment Subcommittee (a subcommittee of the Sustainability Committee). Guided by the findings of regular internal and third-party research, this subcommittee identifies and evaluates the risks with the participation of managers responsible for each business division. Once the risks are identified and evaluated, they are communicated to the business divisions concerned. The strategic implications of the risks are incorporated into strategic planning by the Environment Subcommittee, while business-specific implications are addressed by the relevant business divisions. Under the existing system for groupwide risk management, the Risk Management Committee steers efforts across the corporate group to manage groupwide risks.

To integrate climate-related risk management into this existing system for groupwide risk management, the Risk Management Committee will now coordinate with the Sustainability Committee’s Environment Subcommittee. Specifically, the Environment Subcommittee will inform the Risk Management Committee about important matters concerning risk management and the state of compliance with environmental laws and regulations.

Metrics and Targets

Committing to reach carbon neutrality by 2050, we take action to reduce emissions caused directly by our business activities (scopes 1 and 2) as well as emissions in the supply chain related to business activities across the KOKUYO Group (scope 3).

2024 commitment goal, result

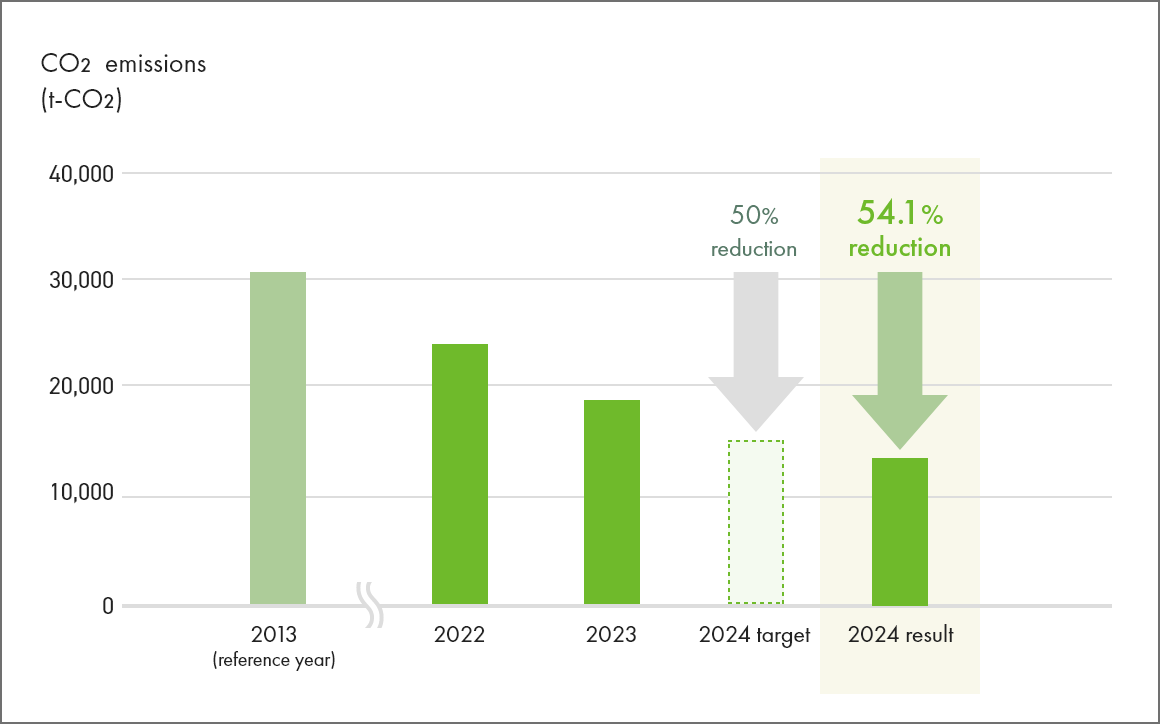

In our third medium-term plan, we set the 2024 commitment goal of reducing emissions by 50% from the 2013 level.

We accomplished this goal. Emissions in 2024 were 54.1% down from the 2013 level.

-

*Coverage: KOKUYO and its subsidiaries in Japan, including its two special subsidiaries (KOKUYO K Heart and KOKUYO Heartland)

| 2013 (reference year) |

2022 | 2023 | 2024 target |

2024 result |

|

|---|---|---|---|---|---|

| CO2 emissions (t-CO2) | 30,683 | 24,101 | 18,741 | 15,341 | 14,085 |

| % reduction | - | -21.5% | -38.9% | -50.0% | -54.1% |

Science-Based Targets initiative (SBTi) Certification for Our Greenhouse Gas Emissions Reduction Targets

We have obtained short-term Science-Based Targets initiative (SBTi) certification for the targets listed below as stepping stones for achieving carbon neutrality by 2050.

- Reduce total scope 1 and scope 2 greenhouse gas emissions by 42% between 2022 and 2030

- Reduce greenhouse gas emissions from the scope 3 category “purchased goods and services” by 25% between 2022 and 2030

- Have suppliers, responsible for 12.5% of our emissions from “purchased goods and services,” set Science-Based Targets initiative (SBTi) goals by 2028

Setting 2027 commitment goals

We have set the following 2027 commitment goals for “respond to the climate crisis” (one of our material issues) as interim targets towards achieving our 2030 Science-Based Targets initiative goals.

- Reduce total scope 1 and scope 2 greenhouse gas emissions by 35% between 2022 and 2027

- Formulate an action plan for achieving 2030 scope 3 target (25% reduction in greenhouse gas emissions from “purchased goods and services” versus 2022 level)

- Have suppliers, responsible for 125,000 t-CO2 of our scope 3 emissions, set Science-Based Targets initiative (SBTi) goals

We will expand the coverage of our scope 3 reporting (reporting of supply chain emissions) and work with our suppliers to support the carbon transition.