Medium-Term Plan

Long-Term Vision, CCC 2030

CCC 2030 is our long-term vision for sustainable corporate development. It envisages a world in which people find personal fulfilment in their work and homelife and enjoy connections with others. We call such a world the “self-directed, collaborative society.” CCC 2030 also redefines the role of our organization in bringing about this vision. It defines us as a Work & Lifestyle Company. Operating in the domains of work and of study and homelife, we go beyond producing tangible goods like stationery and furniture to create fulfilling lifestyles and workstyles. CCC 2030 commits us to developing new businesses and expanding the reach of our business fields, with a target for 2030 of \500 billion in net sales.

Updating the Forest-Like Management Model

The fourth medium-term plan has a critical role to play in placing our organization on the path of high growth toward our long-term vision, CCC 2030, and beyond. Underpinning this plan is an update to our model for business management—the Forest-Like Management Model. We had previously organized our operations into a workstyle field and lifestyle field and into four business segments: furniture, business supply distribution, stationery, and interior retail. However, with this structure, we never fully leveraged the knowledge assets stored in each business. With our various business assets forming a diverse forest-like ecosystem of sustained growth, we will now focus on combining knowledge assets between the businesses so that they all grow as one whole forest. In other words, we will focus on inter-business synergies to drive efforts to expand the reach of the business fields and expand into global markets.

Outline of Fourth Medium-Term Plan: Unite for Growth 2027

- We will establish a framework that prioritizes the cashflow (≈EBITDA) necessary to support profit growth and our overall value over the medium and long term. Guided by this framework and the Forest-Like Management Model, we will commit to gaining a top share in Asia* by 2030 and, in the long run, around the world,* and to maximizing our overall value. (* Refers to our target markets in such)

- We will mount a strategy to expand the reach of our experience value by leveraging our forte in the wow-factor creation cycle. We will use strategic and disciplined investment to drive organic growth (building up existing businesses) and inorganic growth (M&A) in Japan and overseas and build sustained EBITDA growth.

- We will build up talent and knowledge to increase the replicability of business success. We will bolster strategic assets to reduce risks (capital costs) and facilitate sustained growth over the medium and long term.

The Fourth Medium-Term Plan’s Goals

- The fourth medium-term plan has a critical role to play in placing our organization on the path of high growth toward our long-term vision, CCC 2030, and beyond. With this strategic positioning, the plan commits us to the following financial targets for 2027, the final year of the plan: \430 billion in net sales, 20% of total sales made overseas, \43.0 billion in EBITDA, and at least 9% in ROE.

Financial and Capital Strategies

・Balance sheet management

We will strike a balance between EBITDA growth and capital efficiency to achieve our ROE targets (at least 9% in 2027, at least 10% in 2030). That is, we will manage our balance sheet to achieve sustainable growth. The efficiency of our total assets will be improved by offloading more cross-held shares and other non-business assets. To further improve capital structure, we will manage the debt-to-equity ratio and deliver generous shareholder returns.

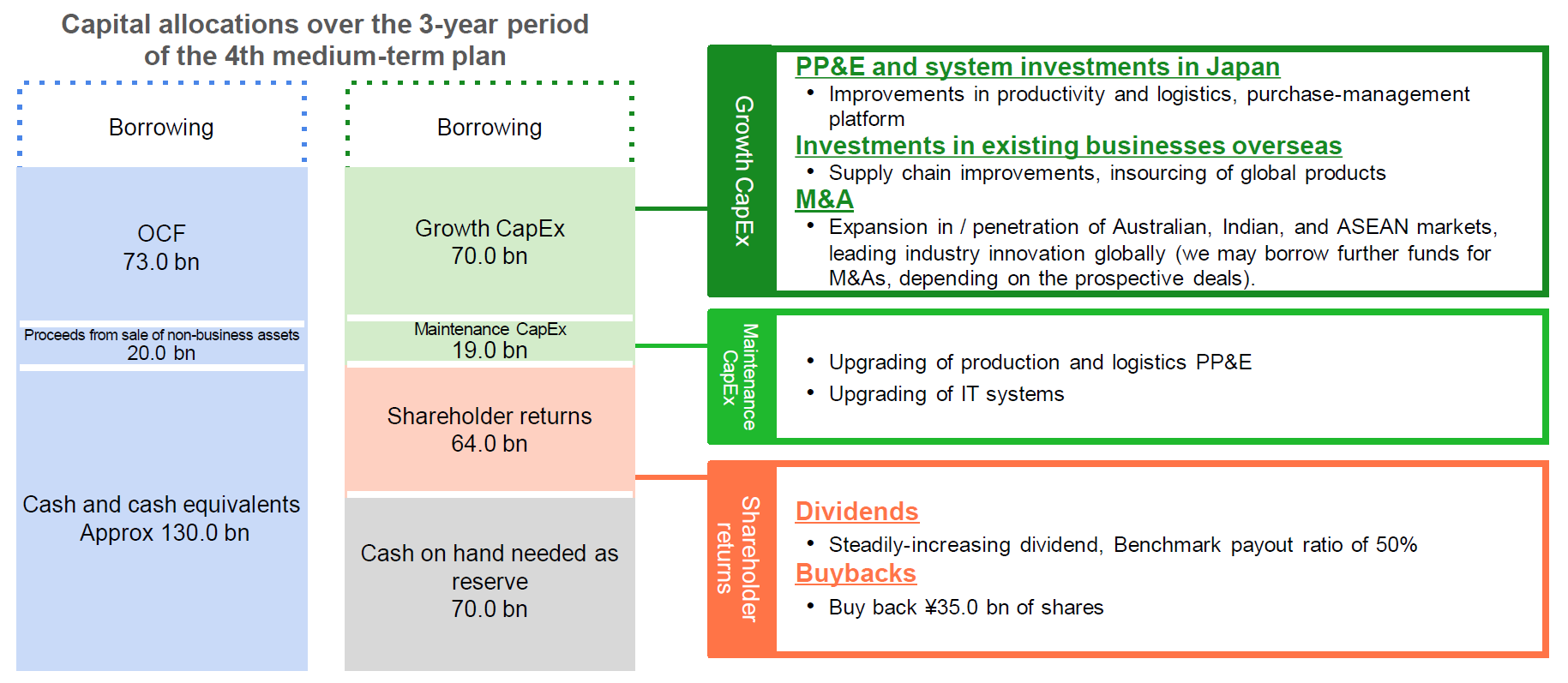

・Capital allocations

Our capital allocation policy will strike a balance between reinvesting in projects to sustain growth and returning profits to shareholders. In our investing activities, we will focus on bolstering our revenue streams, creating further growth in Japan and overseas markets, and forging connections within the industry to lead an industry transformation. We may borrow to fund M&A activities, depending on the potential deals. Shareholder returns will consist of steadily-increasing dividends with a payout ratio of 50% and of a \35 billion buyback program. To dispel dilution concerns, we will also reduce our treasury shares by selling them off to the extent that they represent less than 2% of total issued share.

To find out more, see Unite for Growth 2027.